Unofficial Guide to Cash, Credit Cards, and ATMs for International Travel

How much money should I bring when I travel? Should I exchange currency before I go overseas? What’s the best way to carry cash when I’m abroad? What ATM cards or credit cards are best for international travel?

In this post, we’ve put together our best tips for money and travel.

Note: These tips are based on our own independent travel and research. Certain particulars will only apply to travelers from the States – though many of the concepts can apply more widely.

These are simply tips, not guarantees, as “your miles may vary.” Please do your own research and consult with a professional to determine what may be best for your individual needs.

Updated: February 2024. Originally published: 2017.

Tips for Foreign Currency

Get a No-Fee ATM card.

There are a couple different debit cards that eliminate ATM fees.

We have the Fidelity Cash Management ATM card which works at any ATM with a Visa, Plus, or Star logo. You do need a Fidelity Cash Management account to get the card.

With this no-fee card, we don’t have to worry how much an ATM charges for withdrawals (fees can be significant in some places!). Fidelity reimburses any ATM fee that we might get charged, so there’s no cost to us.

The only hassle we’ve found is that we have to wait a couple days when transferring money into the Fidelity account from another bank. Fortunately, we can make transfers online, so it just requires a little foresight whenever we might need to increase funds for withdrawal.

Use your no-fee ATM card to withdraw foreign currency upon arrival.

As soon as we land at the airport in a foreign country, we make a cash withdrawal at an ATM to get our foreign currency.

Airports pretty much always have ATMs – though the one you want may not be in the most convenient location. For example, in Cancun, the only ATM after you exit customs gives out US dollars only, so you have to go for a trek to find an ATM that gives Mexican pesos.

Check if your card company has an ATM locator so you can see where they’ll be in advance.

I can think of only two circumstances where I’d want to get foreign currency before a trip:

– If you’ve done some research on your destination airport/border crossing and you have concerns about getting foreign currency from an ATM on the spot.

– If you need a large amount immediately after arrival that exceeds the ATM daily withdrawal limit.

Use cash and credit cards with no foreign transaction fees to make purchases.

We only use our ATM card for withdrawing cash. For all other purchases in the country, we either use that cash or our travel credit cards.

You may find that other countries use credit cards a lot less than we do in the States. In certain regions, like Europe, they require credit cards to have an embedded chip.

Do a quick google search to learn how widely credit cards are used in the destination.

Our preference is strongly weighted to use our credit cards whenever possible because 1) we earn miles and 2) they have zero foreign transaction fees.

So if an international vendor ever asks if we want the charge in US dollars or their local currency, we always go for the charge in local currency. You never know how much they’re hiking up the rate to charge in US dollars.

Out of the travel cards with no foreign transaction fees, we use whichever card will get us the most points.

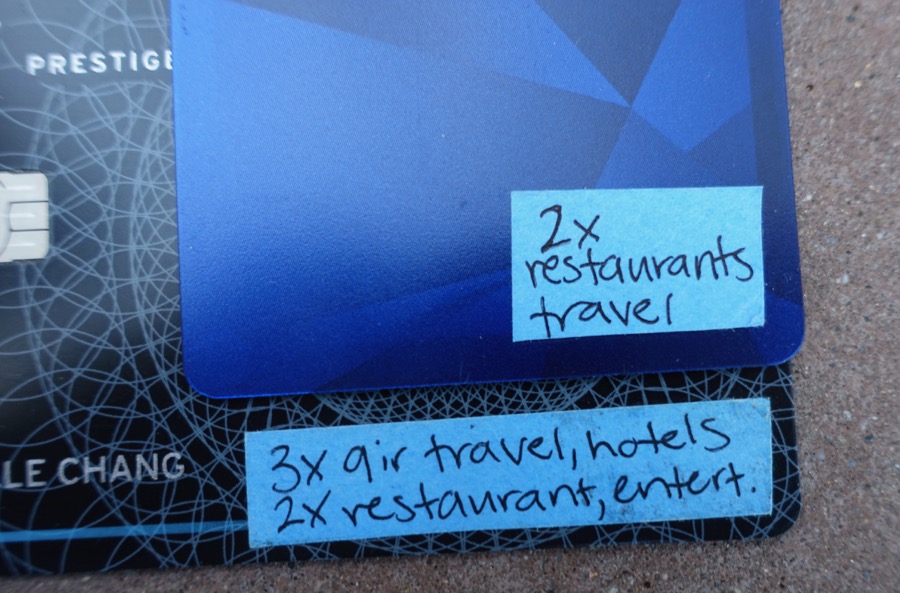

Each card rewards different categories of spending. To keep track, we actually put a little strip of sticky note on each card to remind us how many points we get in different categories for that particular card.

If all things are equal, the card we use most is the Chase Sapphire Preferred – email us if you’d like our referral link.

Bring $100 US as back up

The actual amount of your back up really depends on your comfort level and your typical spending.

This US cash serves as an emergency stash in case everything goes wrong. If the ATMs aren’t working or your cards get stolen, it’s good to have some cash on hand that you can exchange if you really need to.

Remember to keep cash on your person when you travel – don’t put it in checked baggage.

Also try to keep it separate from your other payment methods so that if a wallet gets lost or stolen, you haven’t lost absolutely everything.

We put this tip in from experience because one time when we arrived in Vietnam, the cost of visas on arrival had gone up with our knowledge and the only ATM inside the building didn’t work with our card. (Fortunately, we found some friendly travelers willing to loan us money for our visa until we could access the ATM outside.)

Inform your card company before you travel

Whether its calling in or submitting a travel notice on your online account, it’s important to inform your card issuer of where you’ll be.

Both ATM and credit card companies monitor your account for fraudulent charges, and charges made in unfamiliar places can be one of those red flags. If you forget to do this, you may find your account frozen.

Usually you’ll just need to call in and verify that the charge you made was indeed legitimate, but it can be a big pain if you’re in the middle of a necessary purchase.

(Some banks like Chase no longer use travel notices, but many do.)

Use apps on multiple currency trips

If you’re going to multiple countries with different currencies, it can get confusing to remember how much things cost. We’ve been using the Currency app to quickly translate costs to USD.

Carry your money carefully

To keep our cash and cards safe, we travel with a diversion safe – this can be any hollow object that doesn’t look valuable. Ours looks like a shaving cream can and the bottom unscrews so we can put bills inside.

For day-to-day stuff, we’ve given up on the traditional money belt and instead use a Flipbelt and sneaky hidden pockets inside our clothes (see our reviews on these products here).

It’s also a good idea to keep credit cards in an RFID sleeve that protects info from being scanned without your knowledge.

The other trick we use in case of theft is keeping money and cards in more than one place. That way, if a wallet gets stolen or a pocket gets picked, at least we still have back up somewhere else.

Have an exit strategy

As mentioned before, currency exchanges are not a good deal, so it pays (literally) to strategize a bit with your spending in your last few days abroad.

We try to estimate how much cash we’ll need for daily meals and to get ourselves back to the airport. That way we can plan to withdraw roughly the right amount and leave with our pockets as empty as possible.

We try especially hard to get rid of coins toward the end. Any left over coins after you leave are pretty worthless except as souvenirs.

Have more money & travel questions or suggestions? We’d love to hear from you and continue adding to this post for future readers.

You might also like:

Our SafetyWing Travel Medical Insurance Review

Personal Safety Tips for Travelers

A Checklist for International Travel

These are good tips. I have a trip out of the US in a few days, and I will keep this article in mind.