SafetyWing Nomad Insurance 2.0 Review 2026

After returning to travel post-pandemic, Jedd and I felt that trip insurance and travel medical insurance were more important than ever for our trips.

We first learned about SafetyWing at a digital nomad conference. With further research, specifically considering all the uncertainties around Covid-19 and travel restriction changes, we decided to use SafetyWing for our trips.

In this post, I’ll share the pros and cons of SafetyWing and other important things to know about their Nomad Insurance (now called Nomad Insurance Essential).

What is SafetyWing Nomad Insurance Essential?

SafetyWing is travel medical insurance. It was designed for digital nomads, remote workers, and long-term travelers.

Disclosure: This post contains affiliate links. If you make a purchase through one of our links, we may receive a small commission, at no additional cost to you. Thanks for your support!

Advantage of SafetyWing over other travel insurance include:

– Better prices for long term travel

– You can purchase a policy even after you’ve started traveling

– Covid-19 coverage is included

– You can pay a monthly subscription and cancel at any time

Unlike many insurance plans, SafetyWing will insure you even if your trip doesn’t have an end date or you’re traveling on a one-way ticket. Coverage is worldwide so you don’t need to know where you’re going next!

There’s even some coverage in your home country, if you’re abroad for at least 90 days and then return home for a short time (15 days in the US).

Pricing is based on your age and whether or not you need to be covered while in the United States. One child under 10 per parent (total of two children) can be included in the plan for free.

Get a quote from SafetyWing here:

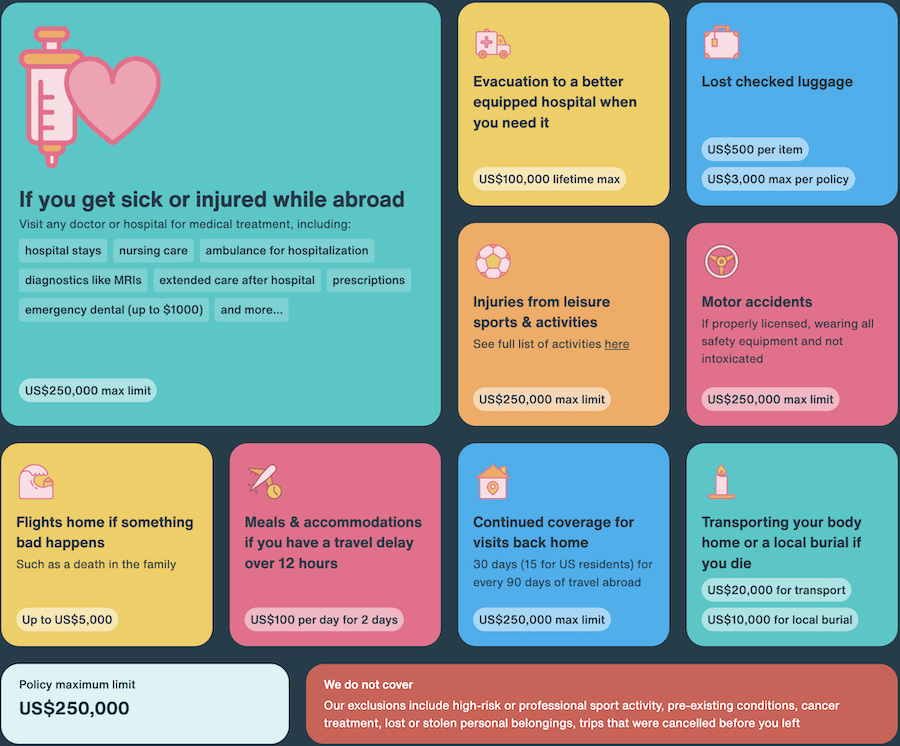

What is covered by SafetyWing:

- Hospital: Room and nursing services

- Intensive care: Up to the overall maximum limit

- Ambulance: Usual, reasonable and customary charges when covered illness or injury results in hospitalization

- Physical therapy and chiropractic care: Up to $50 per day for 3 visits per injury. Must be ordered in advance by a physician.

- Emergency dental: Up to $1,000 to resolve acute onset of pain. Up to the overall maximum limit for surgery following an accident.

- All Other Eligible Medical Expenses: Up to the overall maximum limit.

- Trip interruption: Up to $5,000 to return for an unforeseen emergency in home country.

- Travel delay: Up to $100 a day for an unplanned overnight stay. Subject to a maximum of 2 days.

- Lost checked luggage*: Up to $3,000 per certificate period; $500 per item. Up to $6,000 lifetime limit.

- Natural disaster — a new place to stay: Up to $100 a day for 5 days.

- Political evacuation: Up to $10,000 lifetime maximum.

- Emergency medical evacuation: Up to $100,000 lifetime maximum. Transportation to the nearest adequately equipped hospital is covered, as is up to $5,000 for a return ticket to the original destination, or to home country. Not subject to deductible or overall maximum limit.

- Personal liability: Third person injury ($25,000), Third person property ($25,000), Related third person property ($2,500), Lifetime maximum of $25,000.

- Accidental death & dismemberment (AD&D): Loss of limb or eye ($12,500), Loss of 2 limbs ($25,000), Death ($20,000) for transportation, Lifetime maximum ($25,000) .

- Relative visit: Up to $6000 to cover transport, housing, food (maximum 15 days) for one relative to visit you if you are in hospital intensive care with a life threatening injury or illness.

View SafetyWing prices for your trip here >

What to know about SafetyWing

Here are a few key things to know about SafetyWing to help you decide if this is the right travel insurance for you.

1. SafetyWing focuses on medical emergency coverage for travel. This helps keep costs low, but it does mean that traditional cancelation coverage is not included.

2. Iran, North Korea, and Cuba are not included in the coverage. Citizens from these countries are not able to use SafetyWing, and travelers going to these countries will not receive insurance benefits (with the exception of U.S. citizens visiting Cuba with permission from the U.S. government).

3. Many sports and adventure activities are covered like bungee jumping, horseback riding, surfing, skiing, snowboarding, and cycling.

Medical expenses resulting from motorbike and scooter accidents are covered as long as racing and intoxication are not involved, you’re properly licensed, and are wearing required safety gear.

NEW: Adventure Sports Add-On

As of 2024, available to non-US residents: an additional 30+ adventure sports can be covered up to $100,000 via an Adventure sports add-on for an additional $10 per 28 days. The add-on includes things like tandem sky diving, scuba diving, paragliding, and martial arts.

These coverages are meant for travel activities, so they do not apply to professional athletes or someone practicing/playing regularly for a sports team.

Check the website for exclusions.

4. Emergency medical coverage does not include routine or preventive care, cancer treatment, or pre-existing conditions (acute onset of pre-existing conditions can be covered to an extent).

For more comprehensive health insurance abroad, see SafetyWing’s Remote Health plan.

5. Lost checked luggage is covered but stolen baggage or stolen electronics are not.

NEW: Electronics Theft Add-On

You can add optional coverage for theft of electronics. This reimburses up to $2000 per item for stolen laptops, phones, cameras, and other electronic devices at a cost of $20 per month.

*Make sure you have proof of ownership documents to make a claim.

6. SafetyWing does not cover travelers age 70 and over.

If you’re over 70, you can compare options on Insure My Trip.

7. Claims are submitted online, and the process got a big upgrade in 2024.

Starting a claim involves a simple online form that can be completed in as little as 5 minutes. You’ll need the relevant receipts, medical report, and your bank information.

The new process makes reimbursements possible in 2.7 days. Plus, you can check the status of your claim through your online account on the SafetyWing site. And their customer service team is there to support you as well.

You can see reviews by people who have made claims on Trust Pilot.

In addition to Nomad Insurance Essential for travelers, SafetyWing also offers a more comprehensive international health insurance plan called “Nomad Insurance Complete”.

As of December 2024, this health plan designed for long-term nomads now includes travel coverage as well. (The Complete option does require a 12-month contract.)

Purchase a SafetyWing policy >

About SafetyWing’s Coronavirus Coverage

According to their website:

[Covid] Coverage works the same as any other illness as long as it was not contracted before your coverage start date, and does not fall under any other policy exclusion or limitation.

Testing for COVID-19 will only be covered if deemed medically necessary by a physician. The antibody test is not covered, as it is not medically necessary.

As of April 2021, Nomad Insurance also covers quarantine outside your home country of $50/day for up to 10 days (with the limitation of being once within a 364-day period). The coverage requires that:

– You are covered by Nomad Insurance for a minimum of 28 days.

– Your quarantine is mandated by a physician or governmental authority, because you have either tested positive for COVID-19 OR you are symptomatic and waiting for your test results.

When we were preparing for a trip in January 2022 during the Omicron outbreak, I wrote to SafetyWing to find out: “Does SafetyWing have any coverage that applies if a trip has to get rescheduled because a PCR Covid test result (required to enter the country) does not get processed in the 72 hours before the departure flight?”

The answer is no. While there is Trip Delay and Trip Interruption coverage, a delayed test result would not qualify for this benefit.

I also asked: “Would there be coverage if a government suddenly changes restrictions and someone is no longer able to fly?”

This answer is also no. To cover potential trip cancelation costs, then, you can either:

1) book flights that are refundable/changeable, or

2) purchase a separate trip cancellation insurance at the time of booking, or

3) book with a travel credit card that includes trip cancelation coverage

Is SafetyWing insurance for travelers worth it?

We think so. SafetyWing is flexible, affordable, and offers the coverage that most digital nomads and long term travelers need.

I especially appreciate the new electronics theft add-on. As nomads who don’t need home insurance, we could never get this kind of coverage on its own, and we need our devices to earn a living!

While we haven’t needed to make a claim yet, we have purchased SafetyWing Nomad Insurance policies for all our international trips since Covid.

We plan to continue insuring our international travels through SafetyWing in 2026. We also make sure to book travel with a Chase Sapphire credit card which includes trip cancellation coverage, since this is not include in SafetyWing plans.

Have you found any travel cover for over 70years

Thanks for visiting our blog. I believe our friends over 70 are using World Nomads insurance for their long-term trips.